Oil Markets

Crude oil is a liquid in the Earth, and it is made of hydrocarbons, organic compounds, and tiny amounts of metal. There are many types of crude produced around the world, and the quality of each is reflected in the value. One of its quality characteristics is the sulfur content, which can be defined as sweet or sour, and density ranges from heavy to light. If crudes are light and sweet, there are more expensive as opposed to energy products such as diesel and gasoline. There is a high demand for these grades since they can be processed with refineries requiring less energy.

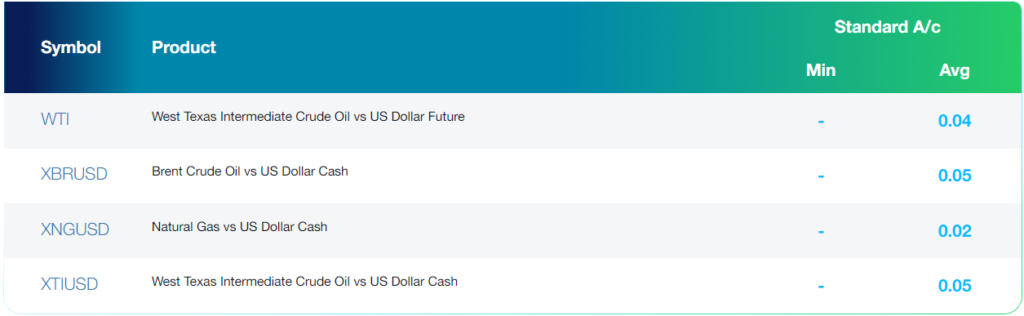

Many types of crude oil differ in their consistency and density, depending on how and where it is extracted. There are over 160 types of crude oil traded on the market, but Brent Crude and WTI serve the most as the oil benchmarks in the global markets. The WTI oil is taken from Wells in the United States and sent to Oklahoma by pipeline. It is mostly referred to as US crude, and it has expensive shipping costs when there is demand around the world. The WTI oil is very sweet and light, making it ideal for gasoline refining. WTI is a higher quality crude than Brent, and it is always priced at a premium.

The Organization of the Petroleum Exporting Countries (OPEC) is a cartel of 14 major oil-producing nations seeking to manage the supply of the commodity to control its prices. When there is a meeting on whether to boost or cut production, it can impact current and future prices directly, and oil watchers globally closely follow the announcements. Another important factor affecting the prices is the major crude reports from the US inventory number as higher inventories will mean less demand from the international markets and will pressure the prices lower. Political factors or wars in oil-producing nations are a major issue in the oil markets and natural disasters such as hurricanes that affect major oil infrastructures.

Coffee Markets

Coffee has become one οf the world’s most profitable commodities. By the 18th century, its cοnsumptiοn and popularity increased significantly in the US during the Civil war. Arabica and Robusta are two different coffee varieties. Arabica is considered a more flavourful bean, with less caffeine and is premium attracting a higher market price. Robusta contains more caffeine and has a bitter taste. Trend followers like to trade Robusta due to its volatility, and traders who prefer more stability choose Arabica.

The price of coffee can be affected by factors such as changing weather conditions, distribution costs, geopolitics, global health issues and the strength of the US dollar. Also, the price of coffee is moved by factors that relate to supply and demand. Major coffee chains in China increased the price of beverages amid rising costs and inflation. Luckin Coffee, Starbucks and Tim Hortons raised prices by between 1 yuan ($0.16) and 3 yuan ($0.47) according to mobile apps and online menus. Starbucks operates more than 5,500 stores in China and after its first-quarter reporting in February 2022, cautioned that rising inflation and staff shortages continued to present a challenging trading environment globally.